nj property tax relief for seniors

The Office of the Tax Collector is located at. Annual Property Tax Deduction for Senior Citizens Disabled Persons.

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

New Jersey Extends 2021 Tax-Filing Deadline for Kentucky Tornado Victims.

. But the state also makes additional property tax relief programs available to certain groups. Please note the tax appeal filing deadline is April 1 2022If your municipality went through a district wide revaluation or reassessment the deadline is May 1 2022. Property Tax Relief Programs.

NJ Tax Relief for Hurricane Ida Victims. Plain extra copy of Will per page. For pages in excess of two per page.

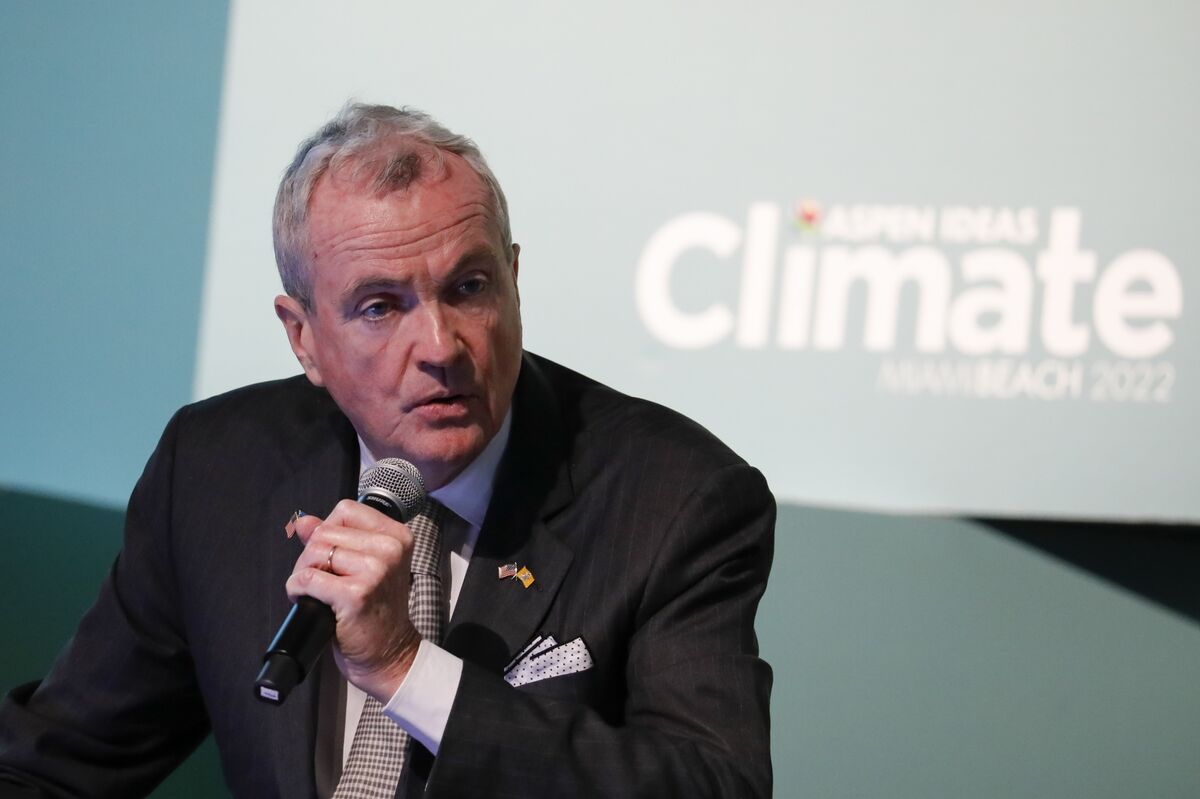

Local newspaper covering news sports police fire and government issues for Bayonne NJ 07002. These 2 benefits are administered by the local municipality. Phil Murphy announced Thursday his administration will extend property tax relief to about 18 million New Jersey households by.

How to make a payment. To qualify you must meet all the eligibility requirements for each year from the base. Is other New Jersey property tax relief available.

The Ocean County Board of Taxation is one of the more advanced assessment systems in the State of New Jersey. Qualifying homeowners who are 65 and older or who are disabled can get up to 250 deducted from their. Treasury Announces NJ Division of Taxation Extends Filing Payment Deadlines for Tropical Storm Ida Victims.

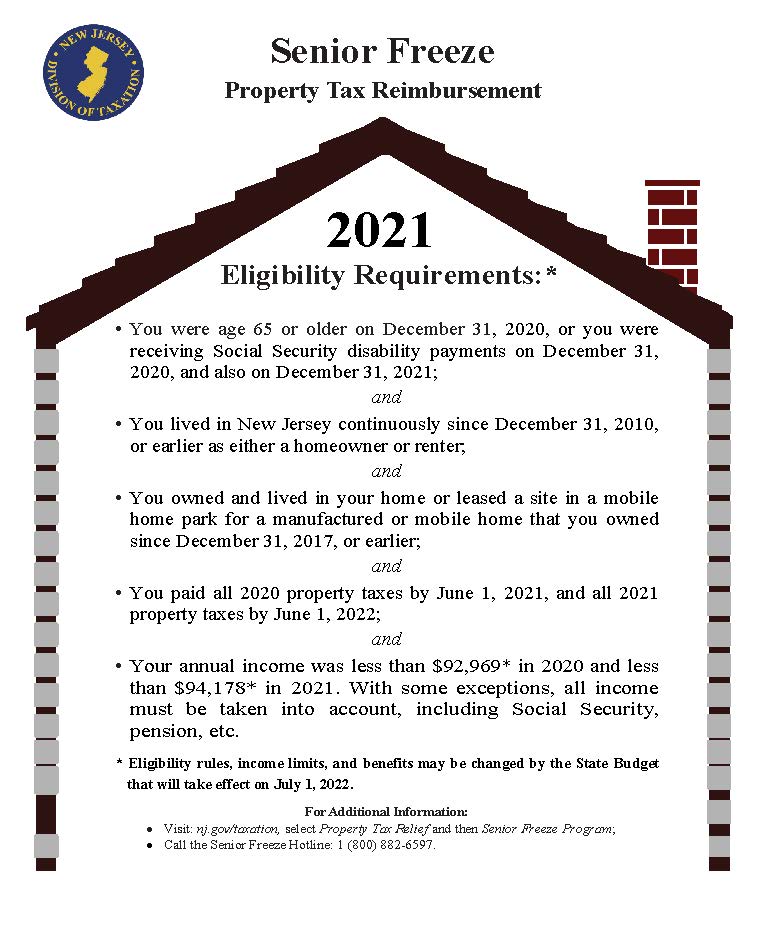

100 Municipal Blvd Edison NJ 08817 On the 2nd floor of the Municipal buildingThe office hours are 8 am to 430 pm. Annual deduction of up to 250 from property taxes for homeowners age 65 or older or disabled who meet certain income and residency requirements. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home.

The NJ homestead rebate program can provide property tax relief to lower-income homeowners. We are here to help. Residents are encouraged to contact the Ocean County Tax Boards office via telephone 732-929-2008 for any assistance.

Click on the links below. Instructions as well as tax appeal forms can be found and printed from our website. Certified copy of Will with proofs for New Jersey county not exceeding two pages including Will and Codicil.

New limitations on Urban Enterprise Zone Exemption Certificates. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281. Filing entering issuing and recording or photostating proceedings in commission for deposition of foreign witness to a Will or Codicil.

Best School For The Real Estate Exam Prep Courses Nj Real Estate Exam Real Estate Classes Real Estate License

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

States With The Highest And Lowest Property Taxes Property Tax Tax States

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

We Re Willing To Make A Deal To Restore N J Property Tax Break Top Biden Official Says Nj Com

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Real Estate

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

Stimulus Update New Jersey Homeowners Could Earn Up To 1 500 In Property Tax Relief Who Qualifies Gobankingrates

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

We Re Willing To Make A Deal To Restore N J Property Tax Break Top Biden Official Says Nj Com

Benefits Of Owning A Home Advantages Of Owning A Home Re Max Nj Home Ownership Home Buying Buying A New Home

Governor Murphy Announces Historic Property Tax Relief Program Youtube

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 06 28 2022 Township Of Little Falls

Documentation For Loan Against Property What You Need To Know Property Tax Tax Debt Relief Loan