rhode island income tax rate 2020

Rhode Island Sales Tax. Interest on overpayments for the calendar year 2020 shall be at the rate of five percent 500 per annum.

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

State income tax rate ranges from 375 to 599.

. Tax rate of 375 on the first 68200 of taxable income. 2022 Child Tax Rebate Program. Rhode Island also has a 700 percent corporate income tax rate.

2022 Child Tax Rebate Program. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet. Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets.

The sales tax rate in Rhode Island is 7. Find your income exemptions. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

The state of Rhode Island does have an individual income tax. Subject to Disability Insurance SDI of 13 up to 74000 taxable wage. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

Each marginal rate only applies to. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Rhode Island Corporate Income Tax ComparisonA home business grossing 55000 a year pays 385000A small business earning 500000 a year pays 350000A corporation earning.

The tax applies to. Like most states with income tax it is calculated on a marginal scale with multiple brackets 3. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Brief summary of Rhode Island state income tax. Income Tax Brackets Rates Income Ranges and Estimated Taxes Due. Find your pretax deductions including 401K flexible account.

Rhode Island state income tax rate table for the 2020 - 2021. Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket. Tax rate of 599 on taxable income over.

Tax rate of 475 on taxable income between 68201 and 155050. This means that these brackets applied to all income earned in 2019 and the tax return that. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per.

This page contains references to specific Rhode Island tax tables allowances and thresholds with links to supporting Rhode Island tax calculators and Rhode Island Salary calculator tools. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

There are no local city or county sales taxes so that rate is the same everywhere in the state. Rhode Island has a. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

Detailed Rhode Island state income tax rates and brackets are available on. The rate so set will be in effect for the calendar year 2020.

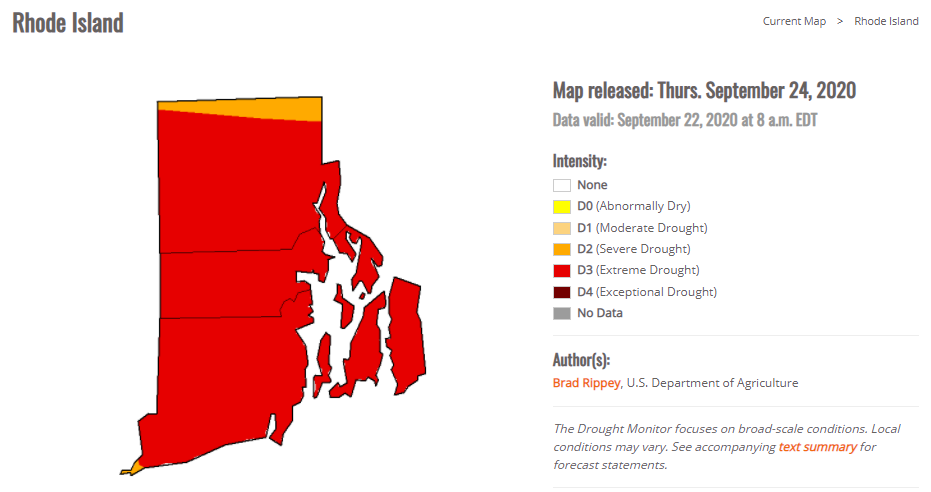

Rhode Island Is Experiencing An Extreme Drought For The First Time In Decades The Boston Globe

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Map Of Rhode Island Property Tax Rates For All Towns

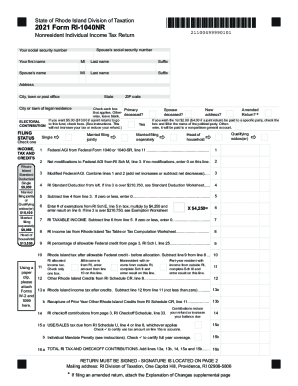

Rhode Island Income Tax Rates Fill Out And Sign Printable Pdf Template Signnow

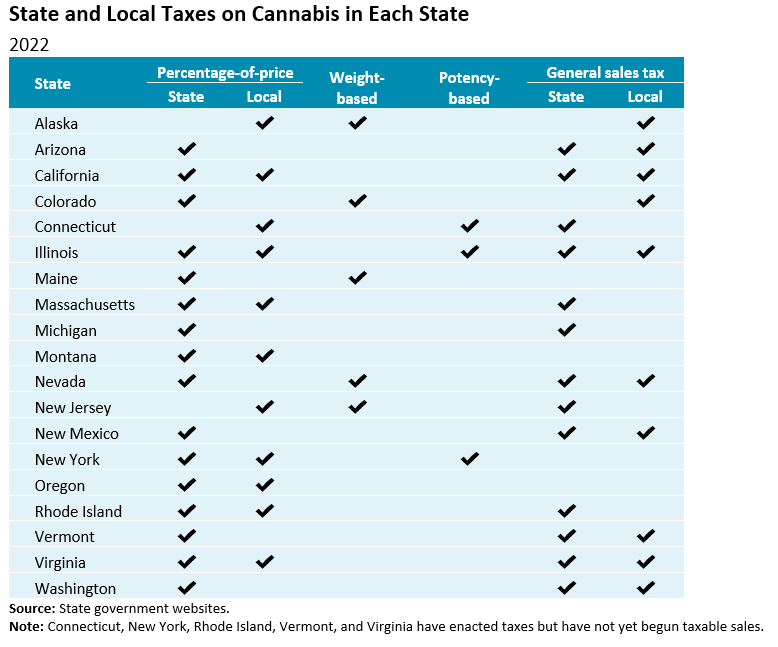

Cannabis Taxes Urban Institute

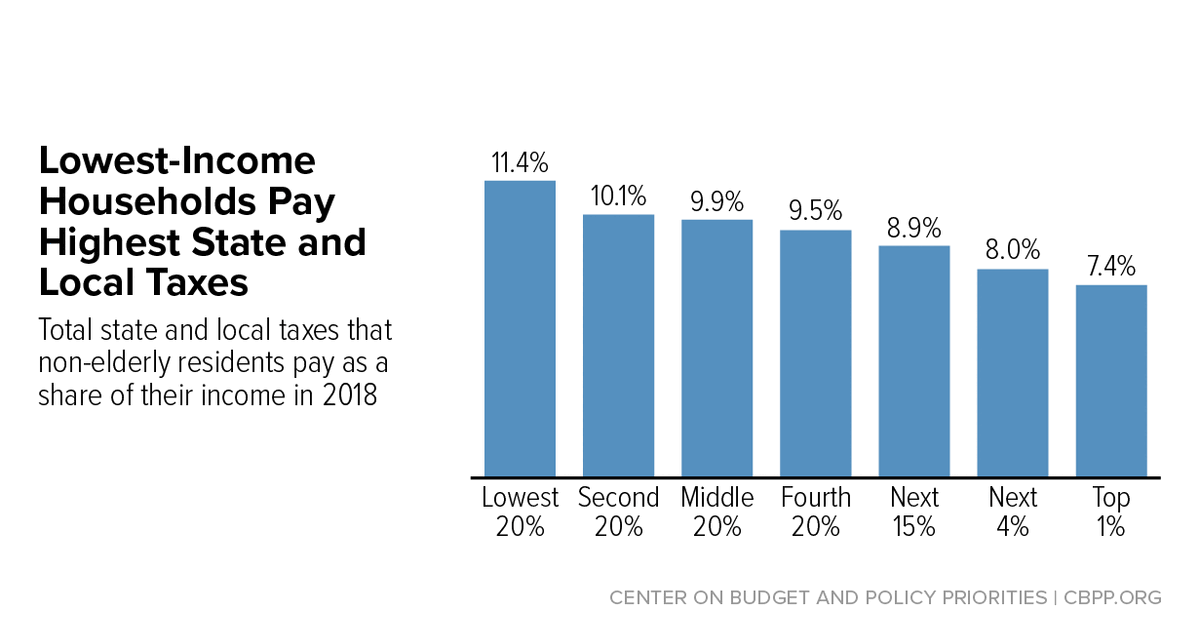

State Taxes On Capital Gains Center On Budget And Policy Priorities

Study Says Corporations Avoid 500 Million In Florida Taxes By Shifting Income

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Individual Income Tax Structures In Selected States The Civic Federation

Rhode Island Employers To See Flat Unemployment Insurance Taxes In 2022 Providence Business First

Incorporate In Rhode Island Do Business The Right Way

Rhode Island Key Performance Indicator Briefing For Q4 2021 Ri S Post Pandemic Economy Grows But Still Lags The Nation In Recovering Jobs Rhode Island Public Expenditure Council

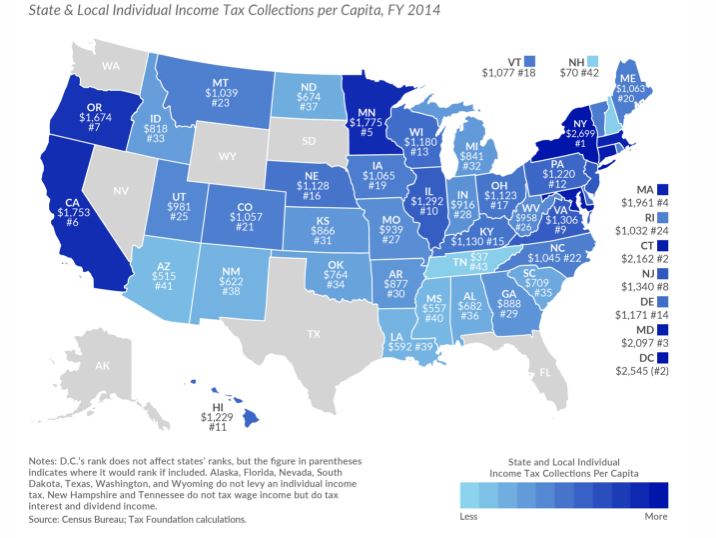

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Pandemic Profits Netflix Made Record Profits In 2020 Paid A Tax Rate Of Less Than 1 Percent Itep

Tobacco Use In Rhode Island 2020

Rhode Island Income Tax Calculator Smartasset

Rhode Island State Tax Tables 2020 Us Icalculator

Tax Withholding For Pensions And Social Security Sensible Money